Most of the time, our housing counsellors work alongside the children of parents who are no longer able to make decisions because of cognitive losses or other cognitive impairments such as Alzheimer’s disease or other illnesses that affect judgment like dementia, frontal dementia or mixed dementia.

A protection mandate: helpful when signing a lease for an incapacitated parent

When a parent loses cognitive autonomy, children often find themselves looking for urgent care in the form of an adapted and secure residence. For example, in the case of someone with Alzheimer’s who is at risk of wandering, children must find an Alzheimer’s special care unit or a residence with coded door systems. In that kind of situation, a protection mandate (or incapacity mandate) is needed in order to sign a lease in a parent’s name or to make monthly withdrawals from the bank to pay the rent.

Why sign a power of attorney?

A power of attorney is a signed contract whereby one person gives another the authority to act on their behalf for certain administrative acts (paying bills, depositing cheques, etc.).

If your parent lives in a senior’s home and needs help managing his/her money and assets, the power of attorney becomes a helpful tool that should be written in advance.

The power of attorney will make your parent’s life easier if he/she no longer feels able to keep up with his/her finances (payments, credit cards, etc.) or is unable to travel in order to make payments. You will also be able to ensure that the payments are made on time and remove this weight from your parent’s shoulders, for whom the transition to a home is a stressful time. In other words, the power of attorney will allow you to act on behalf of your parent if you are appointed as an agent.

The named person (the attorney) who acts on behalf of another person (the grantor) may be a child, an accountant, a spouse, etc. This person must be trustworthy because they will be acting in your parent’s name. They should therefore be honest and not place themselves in a conflict of interest situation.

How is a power of attorney written?

The power of attorney may take the form of a verbal or written contract. However, if it is a written agreement, you will be protecting your parent for two reasons:

1. In the case of a conflict, it will be easier to prove your parent’s claims.

2. It confirms to a third party that the intermediary is not an imposter, that he/she is indeed your parent’s representative.

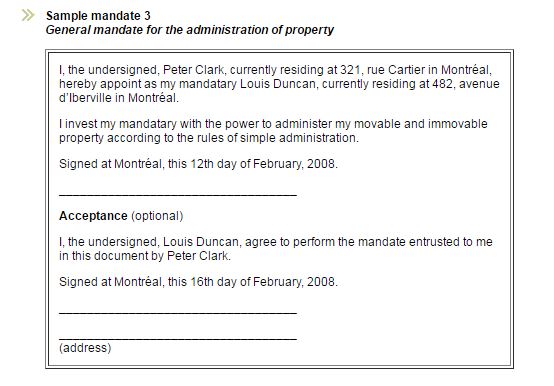

The document may be in the form of a private letter or a more comprehensive document written with the guidance of legal counsel. In any case, the written power of attorney must include:

– the date it was drafted

– the name of the attorney and the grantor

– a description of the responsibilities given

It is not necessary to submit the contract to an attorney, nor is it necessary for the attorney to be present during the drafting of the document. He/she must accept the responsibility given to them.

Types of power of attorney

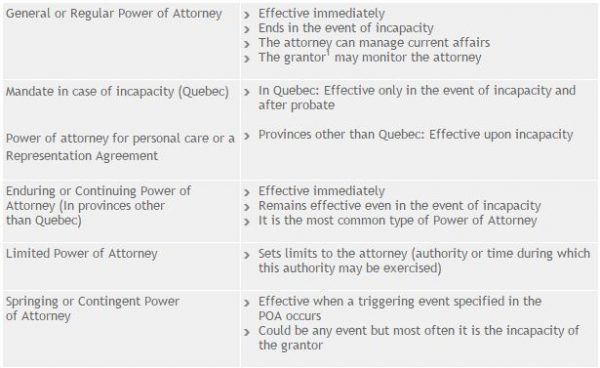

There are 3 types of power of attorney that fill different requirements:

1. General power of attorney

The most comprehensive power of attorney is a general one, as it includes all subject matter related to the contract. While your parent is still mentally able to manage his/her activities, the assigned attorney can perform all acts in his/her name, change financial institutions, cancel a lease, make deposits, etc.).

Model from the Department of Justice: Power of Attorney

2. Special power of attorney

This power of attorney applies to a specific task. For example, your parent could use a special power of attorney if he/she wanted the attorney to sell his/her home. Once the sale was completed, the power of attorney would be void. This power of attorney gives the attorney the power they need to perform the one and only task they were delegated. If your parent wishes to sell his/her car, here is a power of attorney form that was meant for this specific task.

3. Power of attorney for banking

This power of attorney allows the attorney to carry out all transactions related to a single or many bank accounts (withdrawals, paying rent, expenses, etc.). To obtain a banking power of attorney, the attorney and grantor must go to a financial institution and sign the form. In order to reduce the risk of financial abuse, you can put a time limit on the contract in order to protect your parent.

To summarize…

At any given time, the grantor must be in a position to oversee the planned actions. As soon as the mental ability of your parent is compromised, the power of attorney is no longer relevant. You must then certify the protection mandate along with a general power of attorney for controlling the assets of the grantor.

A protection mandate

Sometimes, the relatives of a person with Alzheimer’s disease do not feel comfortable helping their parent. By putting your parent in a home, you are placing their wellbeing in the hands of someone who is qualified. When your parent is unfit, the attorney who was named in the protection mandate having already certified the mandate must start making all the decisions that affect him or her. He/she must choose a residence that suits his/her needs and manage the assets. If nobody was appointed, a trustee will be appointed to the person who is has become unfit.

In the event that your parent is no longer able to care for him/herself or his/her assets because of an illness, such as Alzheimer’s or an accident, a protection mandate would grant the authority to manage care and assets. The protection mandate becomes enforceable only when the court (that must be given proof that the grantor is unfit) certifies it.

If your parent is in a home and his/her assets must be liquidated, most of the attorney’s work will have to be completed within a year of the person becoming unfit. In fact, the attorney will have to sell the grantor’s assets, like his/her house.

Ideally, the protection mandate would be drafted before your parent becomes unfit. They should be sufficiently clear-headed to designate the person who will look after them before they are no longer able to do it themselves. This way, it will be someone that your parent chose rather than someone chosen by your relatives.

If no attorney was chosen before incapacity occurs, then you must open a protective supervision application. The régime de protection exists to protect those who did not prepare a protection mandate.

Mandat d’inaptitude (protection mandate) form

To obtain a general power of attorney and a protection mandate, you can ask an attorney to write a deed that includes both documents.

Need help?

Contact a residence advisor to help you in your search for a residence

844 422-2555

Service free of charge for beneficiaries

Member of ACHQ

Need help?

Contact a qualified residence advisor for help with your search and accompany you until the signing of your lease for FREE.

Our assistance service for the elderly is FREE*

844 422-2555

* Our residence advisors are paid by the network of private residences in Quebec certified by the Ministry of Health and Social Services.